Buy-Sell Agreements and Their Impact on Estate Taxes

Owners of closely held businesses may need to rethink their business succession plan in light of the Supreme Court’s holding in Connelly v. United States on June 6, 2024.

I. An Introduction to Succession Plans and Estate Taxes

Owners of closely held businesses often establish buy-sell agreements to facilitate a smooth ownership transition if an owner unexpectedly exits the business. These agreements set out procedures for what happens to an exiting owner’s shares when certain “triggering events” such as death, disability, or divorce occur.

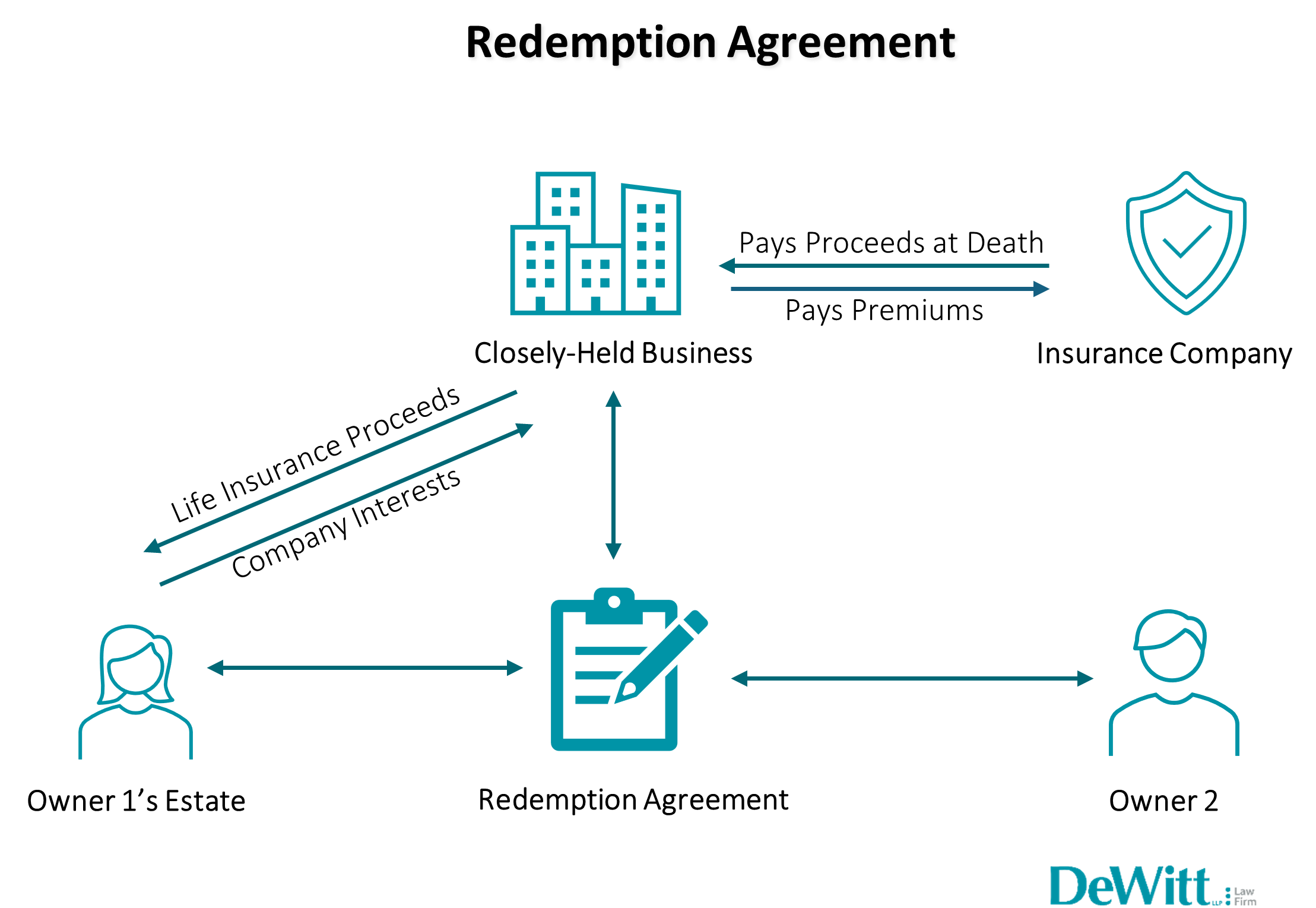

Upon a triggering event, the remaining shareholders, or the company itself, may have the option or obligation to purchase the exiting owner’s shares under the terms of the buy-sell agreement. A buy-sell agreement wherein the company purchases such shares is called a “redemption agreement,” whereas a buy-sell agreement wherein the remaining shareholders purchase such shares is called a “cross-purchase agreement.” In either case, insurance policies are commonly used to fund this purchase. A properly structured buy-sell agreement, when paired with an appropriate insurance policy, will ensure that sufficient funds are available to purchase an exiting owner’s shares and prevent the shares from falling into the hands of outside investors, disinterested family members, and the like.

Although buy-sell agreements often help orchestrate the smooth transition of one’s ownership interests to another, one’s property (including business interests) is generally subject to estate taxes. That is, absent specialized planning, life insurance proceeds and business interests are generally included in one’s “gross estate” for estate tax purposes—which may ultimately be taxed at a rate of 40% if the combined value of a decedent’s estate exceeds the decedent’s lifetime exemption amount (the amount one can gift during life or at death, gift- or estate-tax free). In 2024, the exemption amount is $13.61 million, but the consensus among practitioners is that this amount will be reduced to approximately $7 million starting 2026. Business owners should therefore pay specific attention to how their businesses—and any life insurance policies purchased as part of their business’s succession plan—factor into their gross estate.

II. Connelly v. United States

In Connelly v. United States, brothers Michael and Thomas Connelly utilized a buy-sell agreement and life insurance policies to ensure that their family-owned building supply company would remain in the family if either brother passed away. The brothers’ business succession plan provided that, if either brother died, the company would be required to redeem the deceased brother’s shares if the surviving brother declined to purchase the shares first. The company planned to fund this purchase using the proceeds from a company-owned life insurance policy on each brother’s life.

When Michael died in 2013 and Thomas chose not to purchase his shares, the company used its life insurance proceeds to purchase Michael’s share of the company, and paid Michael’s estate $3 million. Michael’s estate reported this $3 million as the total value of Michael’s interests on Michael’s estate tax return.

The IRS audited the estate tax return and asserted that the value of the company at the time of Michael’s death was $6.86 million (rather than the $3.86 million that the Estate asserted was the company’s total value). To reach this figure, the IRS combined the fair-market value of the company ($3.86 million) and the value of the life insurance proceeds ($3 million). Consequently, the IRS argued that Michael’s interests were worth $5.3 million ($6.86 million × Michael’s 77.18% interest), not the $3 million reported by Michael’s estate.

Michael’s estate argued that the life insurance proceeds should not factor into the value of the company, because the company’s obligation to purchase Michael’s shares was the company’s liability not its asset. The Supreme Court disagreed, and ultimately held that the value of the company for estate tax purposes should include the life insurance proceeds. As a result of this significantly higher valuation, Michael’s estate owed an additional $889,914 in estate taxes.

III. Connelly’s Impact on Your Business’s Succession Plan

As a result of Connelly, the full value of life insurance proceeds under a redemption agreement may be included in the valuation of a deceased shareholder’s stock for estate tax purposes. To this end, the Supreme Court admitted that, to some degree, the Connelly decision “will make succession planning more difficult for closely held corporations.”

The Connelly holding does not necessarily mean that redemption agreements can “never decrease a corporation’s value.” (emphasis in original). As the court noted, where a redemption agreement requires that “a corporation . . . liquidate operating assets to pay for the shares, thereby decreasing its future earning capacity,” it would decrease the value of the corporation.

There may be “other options,” as the Supreme Court noted, that business owners may use as part of their succession plans—such as cross-purchase agreements—but not without their own limitations.

In sum, the lesson Connelly imparts on us is that the design of one’s succession plan is crucial—and the type of buy-sell agreement one’s business has may impact the estate tax liability that a deceased individual’s loved ones may bear the liability of paying.

IV. What Business Owners Should Do

With the anticipated sunset of the historically high estate tax exemption amounts at the end of 2025, many closely held business owners with buy-sell agreements may unknowingly be exposing themselves to relatively larger estate tax liabilities. In light of the Connelly decision, business owners should carefully review their buy-sell agreements and insurance policies currently in place to ensure that their succession plan will not result in unintended estate tax consequences.

If you would like to know more about whether your current buy-sell agreement is right for you and your business, or if you would like to implement a new business succession plan, you may contact Neil S. Schadle at (608) 252-9329 or his assistant, Debbie Miller, at (608) 395-6705.

If you would like to know more about establishing a succession plan, mitigating estate taxes, and accounting for your business within your estate plan, you may contact Michael Bezoian at (608) 283-5618 or his assistant, JoJean Murphy, at (608) 252-9320.