IRS Collection Reminder Notices Resume in January 2024

Practical reminders for dealing with tax debt.

You opened the mail and there is a notice from the IRS. It says you owe taxes. It may have been some time since you’ve been reminded about your balance. Now what?

Do something. While there are options, don’t fall into complacency based on the TV ads that trumpet debt relief. (There is, but in limited circumstances.) Most importantly, don’t throw the notice away—out of sight, out of mind can destroy

your financial future. There is such thing as “too late,” when dealing with the taxing authorities.

Consider that if you owe federal taxes, you probably owe state taxes too. The worst thing is to do nothing. The best thing to do is to contact a tax professional to understand the proactive steps you can take to avoid involuntary collection action.

This is a primer on the IRS Collection process and a reminder that if you owe federal taxes, Wisconsin (or other state) liabilities may be out there too.

****

In January 2024, the IRS is resuming automated collection notices that were previously suspended in February 2022. The moratorium on collection notices applied to reminders, not initial notices of balances due.

The IRS Collection Timeline

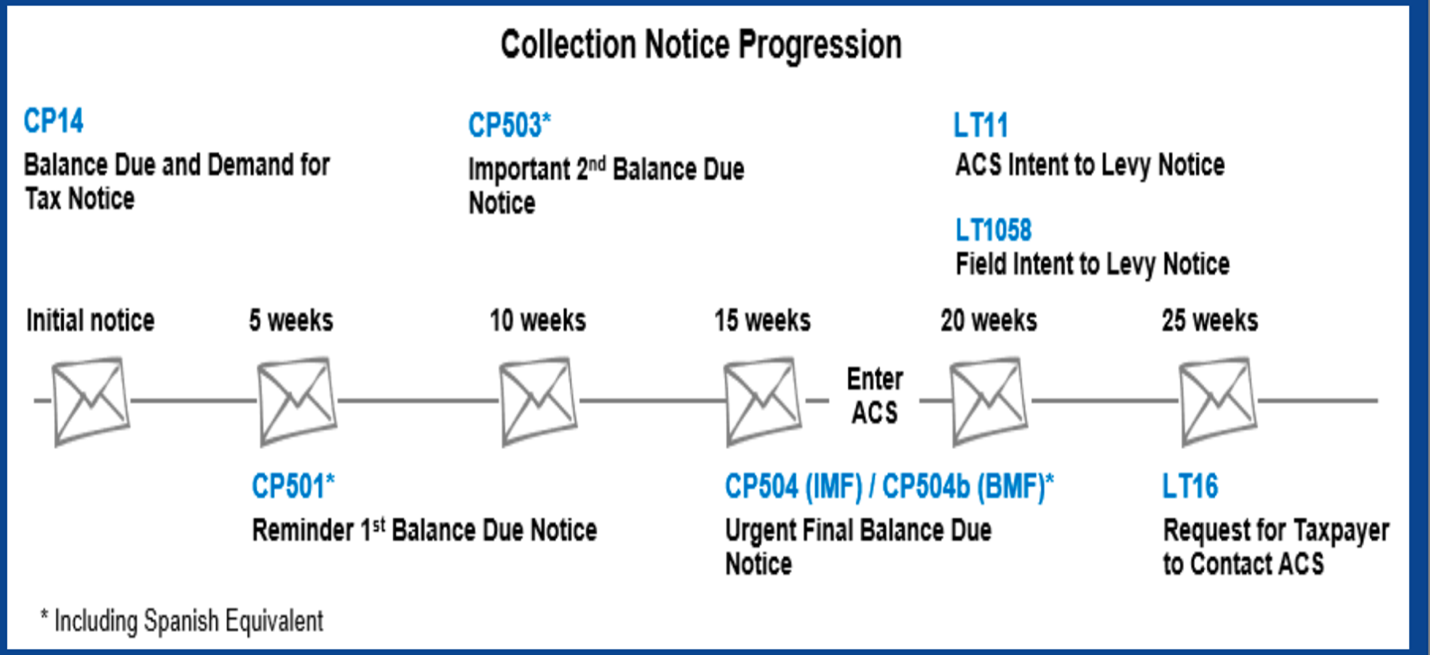

The IRS collection process involves a series of statutory notices to demand the payment of taxes before involuntary collection action occurs. (Involuntary collection action includes the filing of liens and the seizure of assets.) The relevant notices, in chronological order, are CP14, CP501, CP503, CP504 or 504b, LT11 or LT1058, and LT16.

(Source: National Taxpayer Advocate Service – July 20, 2022 Webinar “ Advocating for Taxpayers Who Receive Collection Notices”)

Once the IRS makes an assessment, a lien arises for any unpaid taxes. The lien attaches to all property or rights to property belonging to the taxpayer. This is a statutory or “silent” lien; it does not get filed in a government office and is not a matter of public record. In connection with the balance owed, the IRS is required to issue a notice CP14 (or equivalent notice) within 60 days. This is known as the notice and demand. The IRS may levy (administratively seize) property 10 days after it issues the notice and demand.

I got a collection notice, now what?

-

If you agree, PAY. Remember, penalties and interest continue to accrue until paid in full.

-

If you disagree, contact the IRS and explain why you don’t owe the tax.

- If you cannot pay, explore collection alternatives, as explained below.

Carefully review the notice—if you get a notice and it refers to a timeline, heed the timeline, especially those timelines in Collection Due Process (“CDP”) notices. Examples of a CDP notice includes LT11, LT1058 (see the chart above). If you fail to appeal within the timeline, usually 30 days, you will forfeit the right to seek relief in U.S. Tax Court. This can be catastrophic, particularly if you have a legal defense to the liability.

Temporary Relief for 2020 and 2021

If you owe taxes for 2020 and 2021, and your income is under $100,000 for either tax year, the IRS, recognizing you may not have received a notice of your amount due in over a year, is automatically waiving the failure-to-pay penalty (through March 31, 2024) that would otherwise have been accruing on your account during the moratorium on collection reminder notices. Importantly, other penalties (e.g., failure to file, substantial understatement of income, etc.) and interest continue to accrue.

Collection Alternatives

- Installment Agreement – if you owe under $50,000, you can automatically establish the payment plan on the IRS website; the system will default to the minimum payment the IRS will accept given the liability.

- Offer in Compromise (“OIC”) – an OIC allows eligible taxpayers to settle their tax debt for less than the full amount owed. This option is designed for individuals or businesses facing financial hardship who may not have the means to pay their tax liability in full.

o Lump Sum Cash Offer: This requires a 20% initial payment along with the submission of the offer, and the remaining balance is paid in five or fewer installments.

o Periodic Payment Offer: This option allows taxpayers to make monthly payments while the IRS considers the offer. The first payment is submitted with the offer, and subsequent payments are made while the IRS reviews the application.

o Doubt as to Liability Offer: This is less common and is based on evidence that the tax assessed is incorrect.

- Partial Pay Installment Agreement - is a repayment plan that allows taxpayers to make smaller monthly payments based on their ability to pay. This option is particularly useful for individuals who are unable to afford the full monthly payments required under a regular installment agreement. Eligibility for a PPIA will depend on the IRS’s review of a taxpayer’s financial situation.

- Currently Not Collectible (“CNC”) – CNC status is a temporary relief offered by the IRS to taxpayers facing financial hardship who are unable to pay their tax debts. When a taxpayer is placed in CNC status, it means that the IRS has determined that the individual or business does not currently have the financial capacity to make payments towards their outstanding tax liabilities.

State Liability

An important consideration when you have federal tax liability is to consider the likelihood that you have state liability as well. If you live in Wisconsin, here are a couple of key points about Wisconsin tax liability you should consider:

- Interest accrues at 18%. In some cases, this can be reduced to 12%. In contrast, federal interest is adjusted quarterly and is pegged to the federal short-term rate plus three percentage points.

- Wisconsin has an unlimited statute of limitations to collect—the Department of Revenue likely will find you and your assets and use involuntary collection mechanisms to collect.

- The Department applies payments to penalties and interest first.

Again, do something. Check with a tax professional or call the Wisconsin Department of Revenue to determine if outstanding liabilities exist.

Check your withholding.

As a final step, if you consistently file returns that show a balance due, you should check your withholding. If you and/or your spouse receive multiple W-2’s, consulting with a tax professional or using the IRS withholding calculator, can be an

important step to ensure that your employer withholds sufficient state and federal taxes from your paycheck to cover your yearly tax liability. This can save you a lot of hassle (and penalties for under withholding) come tax time.

DON’T SIT ON YOUR HANDS. YOUR FUTURE SELF WILL THANK YOU!